5 easy mistakes that could invalidate your home insurance against cold weather damage

Is the thermostat too low or have you ignored your gutters this year? These are just a few of the things that could spell trouble if your home is struck by cold weather damage

The current cold spell is prime time for disaster to hit your property whether it's frozen pipes or mould damage. Home insurance should help you keep a cold weather disaster from turning into a full-blown, expensive tragedy. However, a couple of simple mistakes could invalidate your home insurance for damage caused by low temperatures.

The easiest way to make sure you're not caught out this winter is by double-checking your home insurance coverage.

'Knowing the extent of your home insurance coverage is the first step to protecting your home and keeping costs low,' says Matthew Harwood, expert at Confused.com home insurance. 'Stick to the requirements set out in your policy in advance to make sure that you are not invalidating your insurance in case something goes wrong this winter.'

Mistakes that can invalidate home insurance in winter

If you're still a little confused about what to look out for when protecting your home this winter we've rounded up a couple of things that could invalidate your home insurance if cold weather damage strikes.

1. Setting your thermostat too low

Whether you have left your thermostat on low to save energy during the day, or you've turned it down while on holiday, check if your home insurance has a clause about it.

Many home insurance policies may include clauses about heating or draining down if you are not at home. The reason for this is that the thermostat turned too low could contribute to pipes freezing and bursting in winter months.

'In cold spells, heating should be left on low, even when the property is unoccupied. Alternatively, the home can be 'drained down', in other words, the entire water system is cleared of water and the new supply is cut off. This is best for vacant homes,' recommends Jonathan Rolande, founder of House Buy Fast.

Get the Ideal Home Newsletter

Sign up to our newsletter for style and decor inspiration, house makeovers, project advice and more.

2. Leaving your home unoccupied

If you've planned a winter escape or have a second home you need to check if there is a clause in your home insurance about how long you can leave the property unoccupied. If your pipes burst while you're away and go untreated it can cause £1000s in damage.

'Most policies will cover an unoccupied home for either 30 or 60 days, but any longer, and your insurance provider may refuse to pay out for any claims you need to make,' explains Liz Hunter, Director at financial price comparison site Money Expert.

'If you do need to leave your home empty for longer than your policy allows, talk to your insurer. They’ll likely offer you unoccupied house insurance, which may cost more, but will ensure you’ll be covered for an extended period when you are not at home.'

3. Making DIY repairs to essential systems

We're not talking about learning how to bleed a radiator, but about the larger DIY jobs that could affect your plumbing or heating system. While trying to fix it yourself might seem like the most affordable option, it could prove more expensive in the long term if it invalidates your home insurance.

'Heating, plumbing and electrical systems within the home can often be complex and require a trained professional to diagnose and repair any issues you might be having,' says Liz.

'Attempting to fix these essential systems, however tempting, could lead to further damage, putting you at risk of injury and invalidating your home insurance which could result in potentially huge repair bills. If you are not qualified to fix essential systems within your home, make sure you leave it to a professional.'

4. Neglecting your gutters

'Imagine you let the gutters get clogged with leaves that have fallen from trees, which could lead to damp inside your home – or maybe you were aware of a pest infestation, but didn’t act until they caused severe damage. In both these cases, your insurer could actually reject your claim on the grounds of poor upkeep,' says Liz.

'Put simply, if something goes wrong in your home, your insurer will need evidence to ensure that any damage you claim for isn’t just a result of poor maintenance. The only solution here is to keep up with the general wear and tear of your home.'

So make sure you know how to clean your gutters and tackle any winter home maintenance jobs before disaster occurs.

5. Using a wood burner

If you have a fireplace or a wood burner in your home, this won't immediately invalidate your home insurance if your insurer is aware of it – so please don't panic! However, lack of proper maintenance, burning unsuitable materials like wet wood, or not storing fuel properly can all be red-flagged by your insurer.

'Leaving the burner unattended, allowing sparks to escape from the burner, or improperly storing fuel, could potentially lead to an accident. However, this could be seen as negligence by your insurer, leading them to refuse to pay out,' explains Liz.

'It’s important that you always disclose the presence of a wood burner from the outset when obtaining a policy or when seeking renewals.'

When planning any wood burner ideas make sure it is installed by a qualified HETAS professional and is regularly serviced.

FAQs

Is frost damage covered by home insurance?

Unfortunately, most home insurance provides won't cover damage caused by frost. This is because it is predictable, and home insurance is only able to protect against things you can not predict. Instead it is up to you to ensure your home is suitably protected from frost damage.

'There are a number of things that can potentially happen with a property which can lead to a situation where an insurer might claim your actions have invalidated the policy,' adds Jonathan.

'Where possible it is good to try to get legal or independent advice if you don’t think you’ve been fairly treated.'

Rebecca Knight has been the Deputy Editor on the Ideal Home Website since 2022. She graduated with a Masters degree in magazine journalism from City, University of London in 2018, before starting her journalism career as a staff writer on women's weekly magazines. She fell into the world of homes and interiors after joining the Ideal Home website team in 2019 as a Digital Writer. In 2020 she moved into position of Homes News Editor working across Homes & Gardens, LivingEtc, Real Homes, Gardeningetc and Ideal Home covering everything from the latest viral cleaning hack to the next big interior trend.

-

How much to spend on a lawn mower – the ideal price range for small, medium and large gardens

How much to spend on a lawn mower – the ideal price range for small, medium and large gardensI checked in with home improvement experts to find out

By Sophie King

-

IKEA has just launched a massive 96 new products - but these are the only pieces you need to pay attention to

IKEA has just launched a massive 96 new products - but these are the only pieces you need to pay attention toThe classic STOCKHOLM collection just got even better

By Kezia Reynolds

-

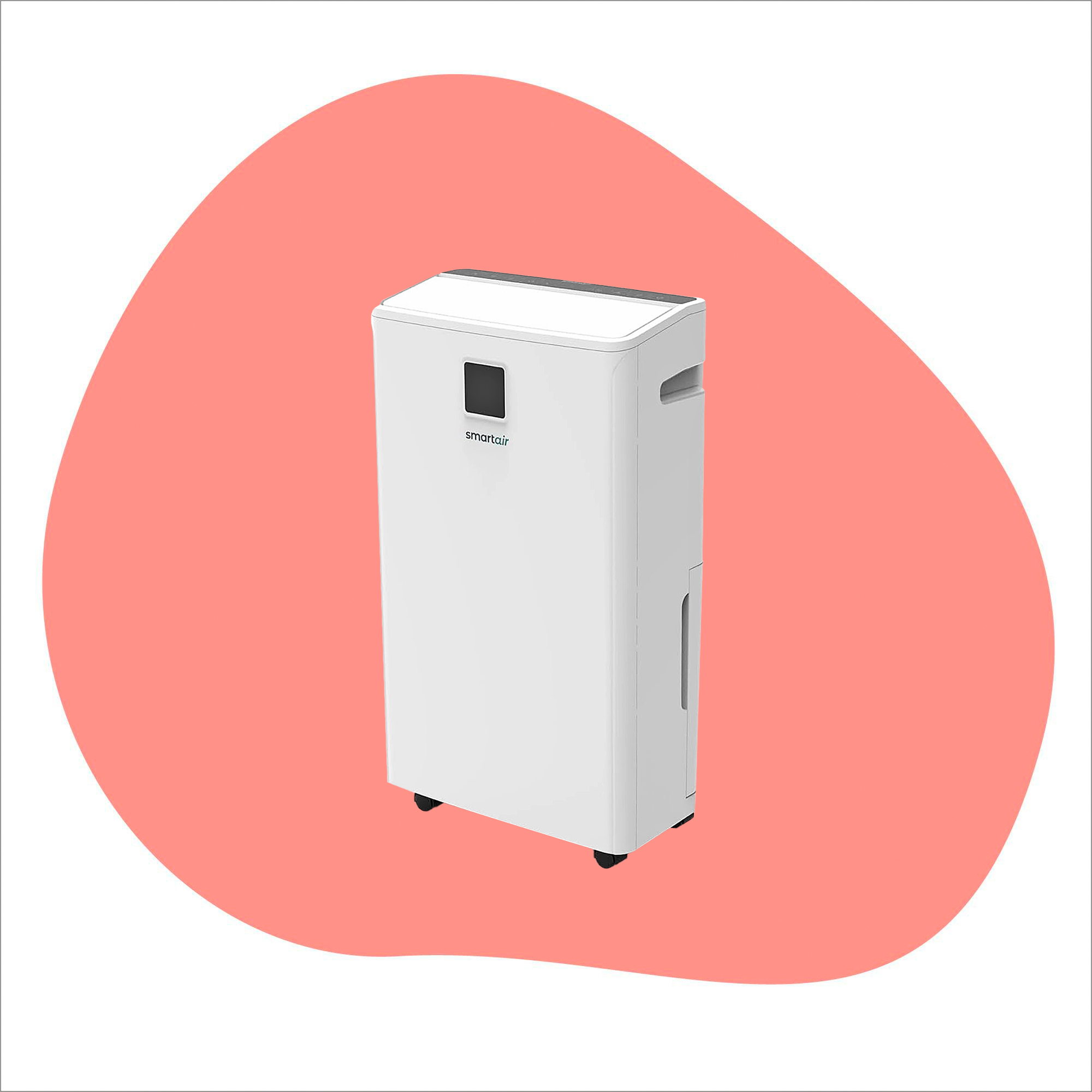

I tried out this neat little dehumidifier for a month – it dried my laundry in half the time

I tried out this neat little dehumidifier for a month – it dried my laundry in half the timeThe 20L SmartAir Dry Zone dehumidifier tackled my laundry drying woes head on

By Jenny McFarlane