How much?! First-time buyers will need this staggering sum to buy a home in years to come...

If you think getting a foot on the property ladder is challenging in today's market, imagine 30 years from now

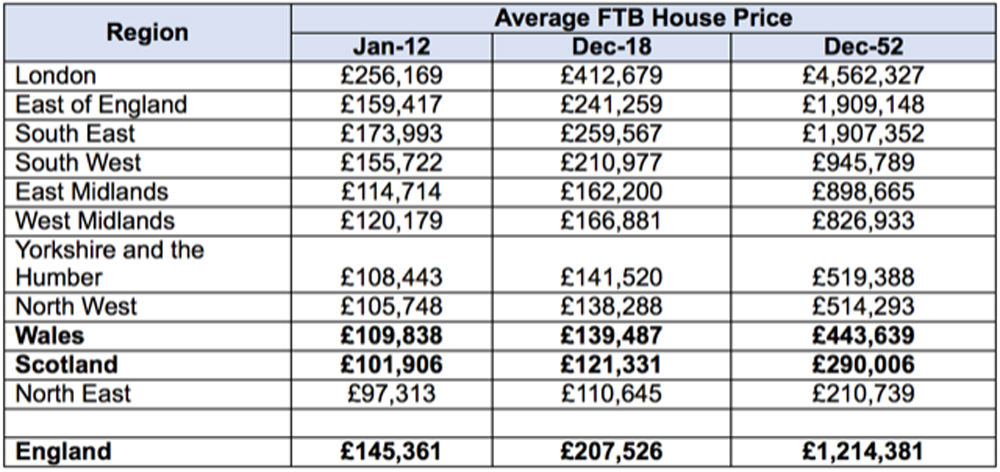

Could this be what's in store for the average first-time buyer house price? New research reveals the current generation could require as much as £1.2million to buy their first home – £4.5million in London!

The eye-watering figure was revealed by one of London’s largest independent letting and sales agents, Benham and Reeves, after looking into potential property prices.

The research revealed the average age of today's first-time buyer is 34. Using historic data from the Land Registry, the agents projected the monthly price changes forward 34 years to see what the average first-time buyer house price could hit for those born today.

Related: Doing this one simple thing when buying a house could save you £3,000

With the average first-time house price in England at £207,526, those born today could be looking at an average of £1,214,381 to get on the ladder in 34 years’ time.

'This research considers the ups and downs of the first-time buyer market historically and how things could play out for the generation of first-time buyers born today if these trends were to repeat themselves,' says Marc von Grundherr, Benham and Reeves Director.

'Of course, it’s impossible to predict the future of the UK property market. Particularly given the current turbulence caused by wider economic and political factors. This research acts as a warning of what could happen if we continue to fail in the delivery of affordable starter homes.'

Get the Ideal Home Newsletter

Sign up to our newsletter for style and decor inspiration, house makeovers, project advice and more.

Predicted first-time buyer house price changes by 2052

London remains the most expensive region of the UK to buy in. In today's market, the average cost is currently £412,679, although this could increase to a whopping £4.5m over the next 34 years.

'While we hope that prices won’t reach these dizzying heights, we’ve certainly seen stranger things happen across the UK property market,' says Marc. 'Who knows what the next 34 may bring?'

Related: 5 important reasons why buying a house makes more financial sense than renting

Best start saving now.

Tamara was Ideal Home's Digital Editor before joining the Woman & Home team in 2022. She has spent the last 15 years working with the style teams at Country Homes & Interiors and Ideal Home, both now at Future PLC. It’s with these award wining interiors teams that she's honed her skills and passion for shopping, styling and writing. Tamara is always ahead of the curve when it comes to interiors trends – and is great at seeking out designer dupes on the high street.

-

Crown Paint has launched new wall colours for the first time in three years, and changed how I think about neutral shades

Crown Paint has launched new wall colours for the first time in three years, and changed how I think about neutral shadesIs terracotta the ultimate neutral?

By Rebecca Knight

-

How to protect seedlings from birds – experts say there's a kind and clever way to stop them pecking

How to protect seedlings from birds – experts say there's a kind and clever way to stop them peckingYes, you can protect seedlings from birds without harming your feathered friends...

By Kayleigh Dray

-

We tried the viral napkin bunny ears hack – it only takes five minutes and will take your Easter table to the next level

We tried the viral napkin bunny ears hack – it only takes five minutes and will take your Easter table to the next levelThis Easter craft is not only beautiful, but really easy to do

By Kezia Reynolds