Halifax figures reveal UK House price growth at slowest rate in six years

Mortgage lender has just released its latest House Price Index, indicating what lies ahead for the housing market

The lender expects house prices and buying to remain subdued for the foreseeable, as Brexit woes continue. The political uncertainty has lead to the housing market to be reported at its slowest growth rate since April 2013.

The Halifax House Price Index 2019 indicates what's in store.

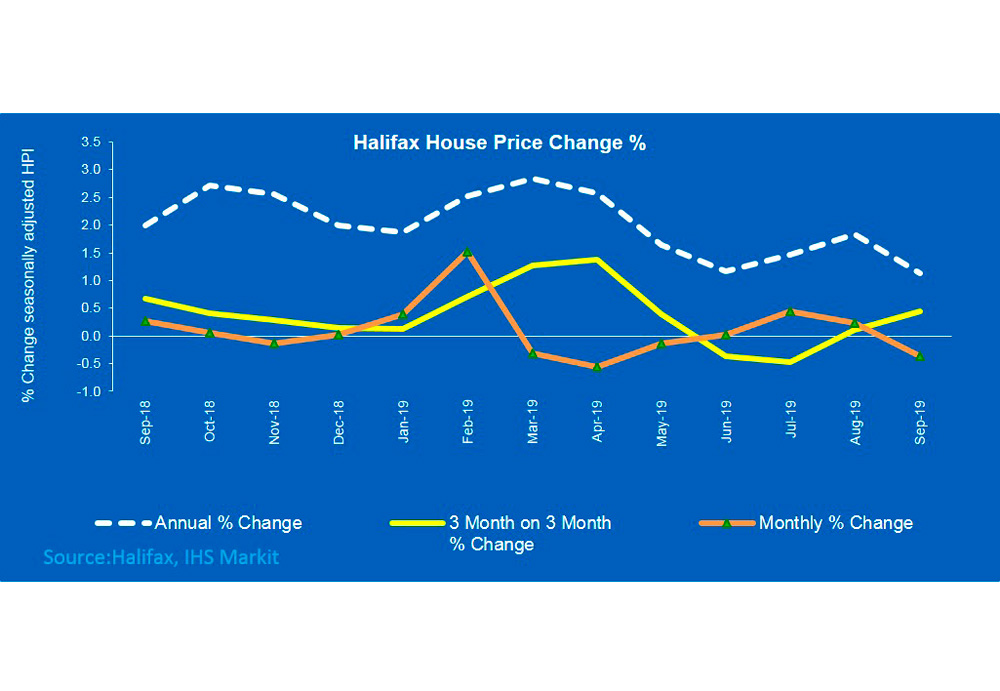

‘Annual house price growth slowed somewhat in September, rising by just 1.1 per cent over the last year,’ explains Russell Galley, Managing Director, Halifax.

‘Whilst this is lowest level of growth since April 2013, it remains in keeping with the predominantly flat trend we’ve seen in recent months.'

Related: The Phil Spencer news property fans need to know about

Russell goes on to say, ‘Underlying market indicators, including completed sales and mortgages approvals, continue to be broadly stable.'

'Meanwhile for buyers, important affordability measures – such as wage growth and interest rates – still look favourable. Looking ahead, we expect activity levels and price growth to remain subdued while the current period of economic uncertainty persists.’

Get the Ideal Home Newsletter

Sign up to our newsletter for style and decor inspiration, house makeovers, project advice and more.

Halifax House Price Index 2019 key findings

HM Revenue & Customs monthly *data shows a rise in UK home sales in August.

UK seasonally adjusted house sales in August were 99,890 – a figure up by 16 per cent, from July of the same year. Significantly the highest level since November 2018.

Year-on-year, transactions in August 2019 were approximately 1 per cent higher than August 2018 (-0.4 per cent lower on a non-seasonally adjusted basis).

Mortgage approvals have fallen from July.

Bank of England **figures show that the number of mortgages approved were 65,545 in August – a 2.2 per cent fall from July.

RICS Residential Market Survey shows a flatter trend in demand

The latest set of results of RICS Residential Market Survey shown a flatter trend in demand with a net balance of plus 3 per cent, in August 2019 – following a couple of months in which new buyer enquiries increased modestly. This is in contrast to plus 6 per cent in July. Newly agreed sales edged further down into negative territory with a net balance of -8 per cent (from -6 per cent in July). New instructions to sell were more or less flat, for a third consecutive month.

The average UK house price is now reported at £232,574.

House prices in September were 1.1 per cent higher than in the same month a year earlier.

On a monthly basis, house prices have fallen by by 0.4 per cent However in the last quarter, July to September, house prices were 0.4 per higher than in the preceding three months of April to June.

Related: Brexit house prices – what do experts think will happen to the housing market in 2019?

*Source: HMRC, seasonally-adjusted figures.

** Source: Bank of England, seasonally-adjusted figures.

Tamara was Ideal Home's Digital Editor before joining the Woman & Home team in 2022. She has spent the last 15 years working with the style teams at Country Homes & Interiors and Ideal Home, both now at Future PLC. It’s with these award wining interiors teams that she's honed her skills and passion for shopping, styling and writing. Tamara is always ahead of the curve when it comes to interiors trends – and is great at seeking out designer dupes on the high street.

-

How to set up a drip watering system that saves water and a lot of effort

How to set up a drip watering system that saves water and a lot of effortKeep your plants hydrated (and your water bill down) with this clever garden watering solution

By Natalie Osborn

-

I unboxed the Ninja Slushi – here's what happened

I unboxed the Ninja Slushi – here's what happenedThe Ninja Slushi is the stuff of dreams for summer entertaining

By Molly Cleary

-

Should you invest in a pot filler or are they just a high-end kitchen fad? I asked kitchen experts whether they're set to be a trend beyond 2025

Should you invest in a pot filler or are they just a high-end kitchen fad? I asked kitchen experts whether they're set to be a trend beyond 2025A high-low approach to kitchen design is the key to creating a stylish space in your budget

By Holly Cockburn