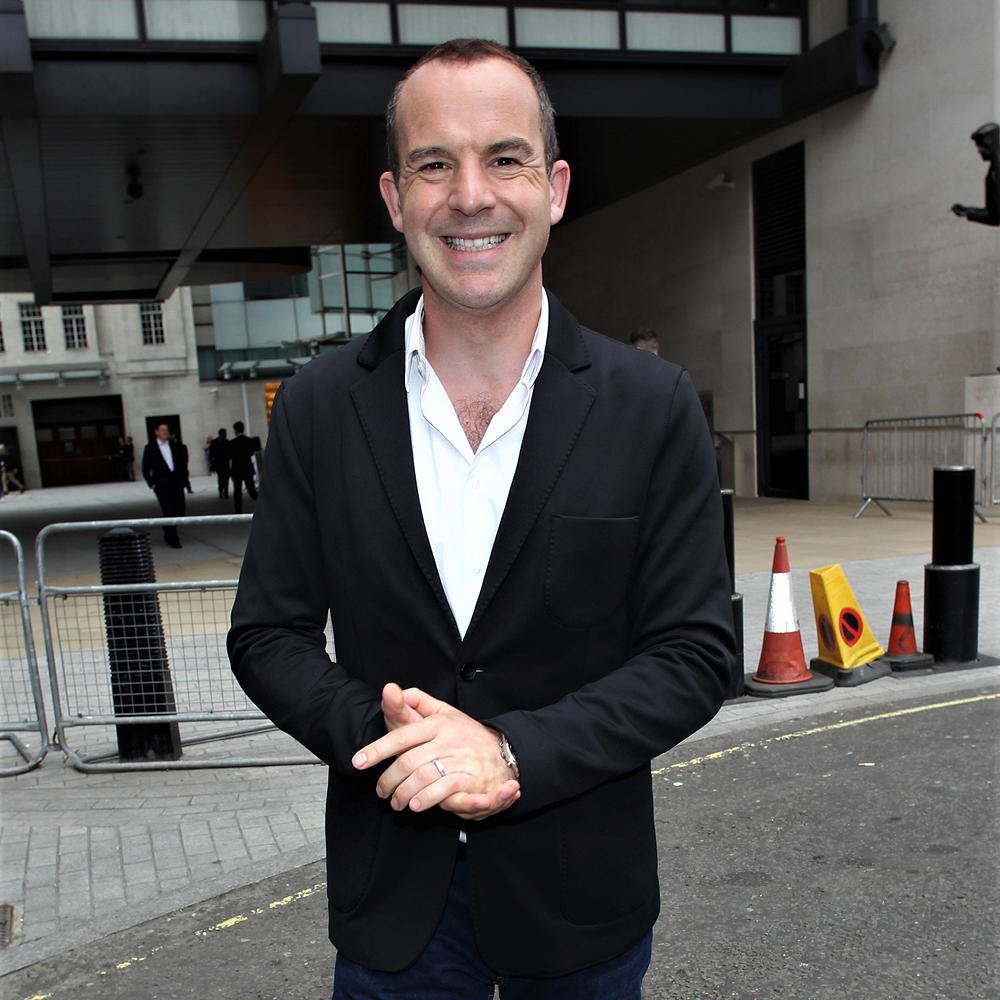

Martin Lewis explains how to reduce your mortgage payments post lockdown

You could save £160 a month

Right now is a tricky financial period for nearly everyone. If you are finding it tough to keep on top of your mortgage payments, Martin Lewis has some words of advice on how to reduce your mortgage payments. Helping you to make your finances more manageable, and hopefully save a little money too.

Speaking on This Morning, the money-saving expert told Phil and Holly that now was the perfect time for people to be looking to reduce their mortgage repayments.

How to reduce your mortgage payments

'UK interest rates are at their lowest in 325 years. even Phil doesn't remember that far back,' quipped the savings guru. 'Mortgage rates are at a historic low. You can get two year fixes for 1. 1 per cent. 5 year fixes from 3.5 per cent.'

'So if you are someone who has a full income or even furlough income, that will be factored when you look at what mortgage you can get, and a good credit score you should be checking right now to see if you can cut the price of your mortgage.

'So to just give you some impetus, Sam tweeted me: "Thanks Martin I try to keep financially savvy, just fixed my mortgage for 5 year saving £160 a months. Nearly £10,000 saved over the fixed period."

'Mortgage rates are low ,you need more equity to get them right now. If you've only got 5 per cent equity in your house, you won't be able to get one. But it is worth checking. Everybody should be checking if they can get one.'

Fixed rate or variable mortgage

But which mortgage interest rates dropping Phil asked whether homeowners should be looking to get a fixed rate or variable mortgage.

'Look a fixed rate gives you certainty of you know what you are going to pay,' explained Martin. 'As long as you are not planning to move, hedge towards a longer fix, head for five years. If you can get five years, even though there's a chance that mortgage rates might go down, that surety of knowing it's locked in is really important.

'What people should be doing right now is speak to your existing lender and say what could you give me, because that might mean low fees. Once you've done that go to a whole other mortgage comparison website. Look at all the deals on the market.

'Finally, I would just speak to a mortgage broker, and you shouldn't be paying them upfront. Only paying them if you get a mortgage through them. Often some of them do it just by taking the fee from the lender.

'The reason I would talk to them is the details of what credit score you need or what affordability check lengths to go to isn't public. But mortgage brokers know. They are good at filtering you through to the place that you are most likely to be accepted.

'Everybody check – can you cut the cost of your mortgage right now? Because you could save thousands.'

Related: Martin Lewis says this is why he wouldn't be buying a house right now

Will you be following Martin's advice?

Get the Ideal Home Newsletter

Sign up to our newsletter for style and decor inspiration, house makeovers, project advice and more.

Rebecca Knight has been the Deputy Editor on the Ideal Home Website since 2022. She graduated with a Masters degree in magazine journalism from City, University of London in 2018, before starting her journalism career as a staff writer on women's weekly magazines. She fell into the world of homes and interiors after joining the Ideal Home website team in 2019 as a Digital Writer. In 2020 she moved into position of Homes News Editor working across Homes & Gardens, LivingEtc, Real Homes, Gardeningetc and Ideal Home covering everything from the latest viral cleaning hack to the next big interior trend.

-

My go-to Ninja coffee machine is on sale for Easter weekend

My go-to Ninja coffee machine is on sale for Easter weekendIt makes coffee shop quality achievable at home

By Molly Cleary

-

When to plant out annual flowering plants for vibrant, colourful garden borders – and give them the best start, according to experts

When to plant out annual flowering plants for vibrant, colourful garden borders – and give them the best start, according to expertsNot sure when to plant out annual flowering plants? We've got you covered...

By Kayleigh Dray

-

I'm a kitchen decor editor and didn't like this tableware trend - until I saw H&M Home's designer-look plates

I'm a kitchen decor editor and didn't like this tableware trend - until I saw H&M Home's designer-look platesThey made it easy to justify a new crockery set

By Holly Cockburn