Insurance expert reveals the mistakes that could invalidate your home insurance after a flood

Whether you've had a leak or a full-on flood you need to read this

Heavy rain over the last few weeks has made flooding a sad reality in many parts of the UK. Whether you've experienced a small leak or a full-on flooded kitchen, you might be hunting for some water damage insurance claim tips.

The first port of call, if you are concerned about a potential flood, is to work out how to spot the signs of a leak. This will go a long way in helping to protect your home, however, in some cases flooding is unavoidable and you will need to rely on your home insurance.

Water damage insurance claim tips and mistakes

Unfortunately, insurance payouts are not automatic and don't always run smoothly, especially if you fall prey to some common mistakes that could invalidate your claim. An insurance expert has shared his property advice about claiming insurance after water damage.

1. Not taking photos of everything

It may feel like a grim task – why would you want to document damage to your beloved home? – but according to Kevin Pratt, insurance expert at Forbes Advisor UK, it is a crucial step in making sure you gather all the information the insurance provider will need to assess your claim.

'Your insurer will want as much information as possible about the extent of damage, so it’s a good idea to take photographs of every room', Kevin said. Once you've sent all the information and photos through, 'the insurer may send a loss adjuster to determine the value of your claim - they should be on hand to help you complete the paperwork and follow the correct procedures.'

2. Start repairing your home right away

Again, this is a completely understandable impulse, but before you set to it can create problems when claiming insurance. Kevin advises against doing anything until you've had the green light from the insurance provider.

'Unless those repairs are essential to keep you safe if you’re still in the property, or to prevent further damage happening. Keep receipts for any work done,' he says. The same applies to throwing away damaged items – don't do it until it's been okayed by the insurer.

Get the Ideal Home Newsletter

Sign up to our newsletter for style and decor inspiration, house makeovers, project advice and more.

Kevin also explains that for insurance purposes, it may be necessary to follow your insurer's advice on drying and repairing your property. 'A loss adjuster should advise you on how to set about drying your property and restoring it to its original condition. The adjuster is appointed by or employed by your insurance company.'

'If you want someone to represent your interests first and foremost, perhaps because of a dispute over the claim you’re making, you can employ a loss assessor - but this is likely to cost several hundred pounds.'

3. Not considering flooding protection for the future

'If it looks like flooding might become a regular problem at your address, you could ask your insurer or landlord to fund flood resilience measures as part of the repairs,' explains Kevin, pointing out that not many people know this.

'This might include fitting moveable barriers to doors, windows, and airbricks, raising plug sockets and appliances, and installing waterproof surfaces wherever appropriate.' This again will involve an assessment but is well worth pursuing if you suspect you are likely to get flooded again in the future.

Make sure you're not left out of pocket by this heavy August rainfall and avoid these mistakes.

Anna Cottrell is Consumer Editor across Future's home brands. She moved to the world of interiors from academic research in the field of English Literature and photography. She is the author of London Writing of the 1930s and has a passion for contemporary home decor and gardening.

-

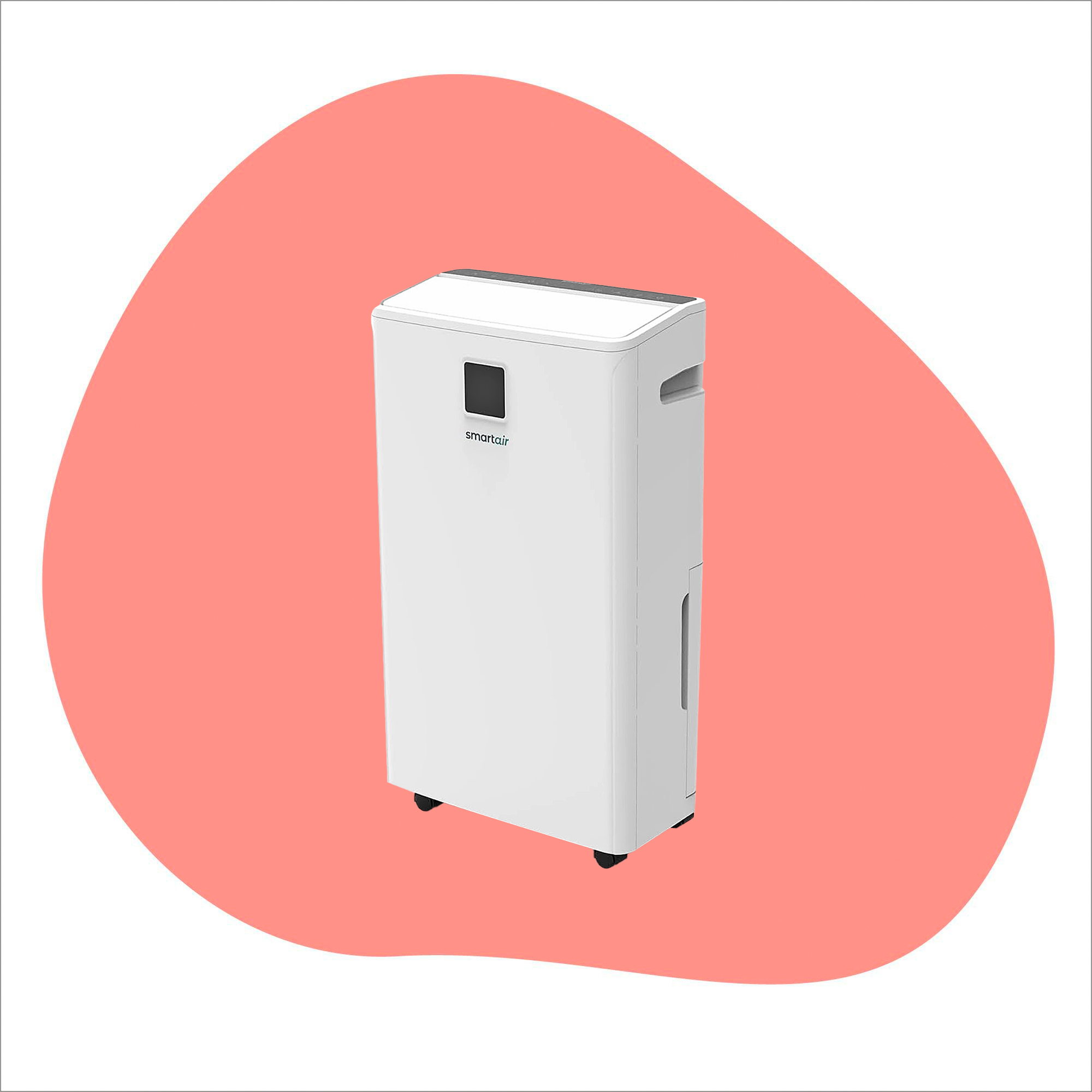

I tried out this neat little dehumidifier for a month – it dried my laundry in half the time

I tried out this neat little dehumidifier for a month – it dried my laundry in half the timeThe 20L SmartAir Dry Zone dehumidifier tackled my laundry drying woes head on

By Jenny McFarlane

-

I’m seeing pastel garden furniture at all my favourite brands this spring, but QVC’s sorbet collection impressed me the most

I’m seeing pastel garden furniture at all my favourite brands this spring, but QVC’s sorbet collection impressed me the mostFresh pastel shades are a great way to liven up your outdoor space

By Kezia Reynolds

-

Don't tell my flatmates, but Joseph Joseph's clever new sink range finally made me enjoy washing up

Don't tell my flatmates, but Joseph Joseph's clever new sink range finally made me enjoy washing upI didn't know stylish washing up accessories existed until I saw this collection

By Holly Cockburn