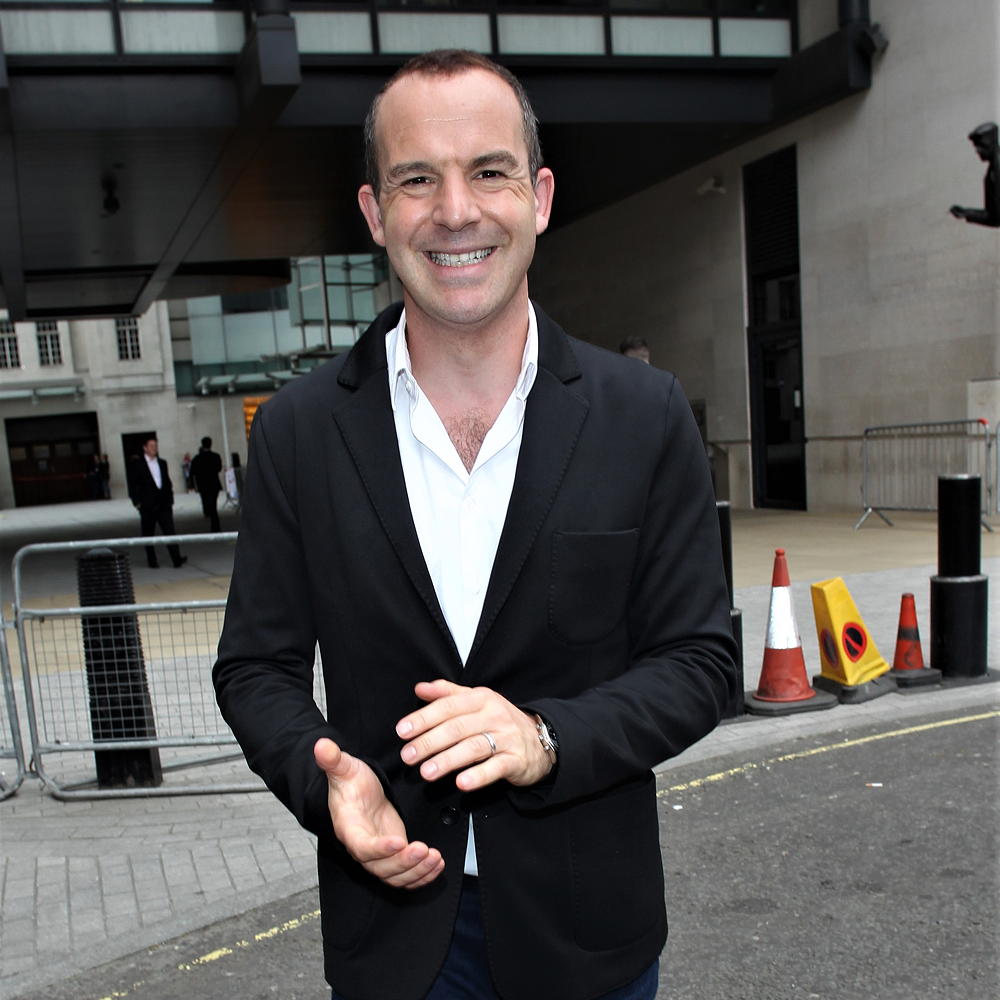

Martin Lewis warns despite stamp duty cuts now might not be good time to buy – here’s why

The saving expert explains shares his advice

Money expert Martin Lewis has warned home buyers that now might not be the best time to invest in a new home, despite the stamp duty cut.

Related: Ordered furniture from a company now in administration? Martin Lewis offers advice

Martin Lewis' stamp duty warning comes in the wake of Chancellor Rishi Sunak's stamp duty announcement last week.

'The Chancellor made a huge housing intervention last week, scrapping stamp duty in England and Northern Ireland for properties up to £500,000,' wrote Martin Lewis in the weekly MoneySavingExpert.com newsletter.

'Nine in 10 purchasers won't pay a penny, and those who do will save £15,000. Plus UK interest rates are at a 325 yr historic low, so mortgage rates are seriously cheap, meaning it's easy to think this is the moment to buy.'

But as Martin explains, it isn't as simple as that. The current mortgage freeze means that many first-time buyers will have to stump up much bigger deposits. On top of that, there is the looming recession and ongoing uncertainty over house prices.

'The housing market faces a period of real uncertainty, and [the Chancellor] wants to get it moving,' explains the savings expert. 'The fact he feels intervention is needed raises a point of caution in itself. Plus of course, as the stamp duty rise is temporary, it could cause a demand bubble.'

Get the Ideal Home Newsletter

Sign up to our newsletter for style and decor inspiration, house makeovers, project advice and more.

'While it's almost certainly a good time to get a mortgage if you can, sadly only a crystal ball will tell you if it's a good time to buy or move,' he adds.

For many first-time buyers who have managed to save up more than a 20 per cent deposit, buying a house during the stamp duty holiday could be an opportunity to make some real savings. However, Martin does have a few words of advice.

'Ensure the financials are sound, don't overstretch yourself, pick a budget and stick to it (even if that dream home is just a little bit more, stick to your budget). Buy a home you'd be happy to stay in for longer, as that's the best insurance possible,' he advises.

Related: Martin Lewis explains how to get £5,000 to improve your home AND cut your energy bills

Will you be taking advantage of the stamp duty cut or waiting it out for a more stable time to invest?

Rebecca Knight has been the Deputy Editor on the Ideal Home Website since 2022. She graduated with a Masters degree in magazine journalism from City, University of London in 2018, before starting her journalism career as a staff writer on women's weekly magazines. She fell into the world of homes and interiors after joining the Ideal Home website team in 2019 as a Digital Writer. In 2020 she moved into position of Homes News Editor working across Homes & Gardens, LivingEtc, Real Homes, Gardeningetc and Ideal Home covering everything from the latest viral cleaning hack to the next big interior trend.

-

The 6 outdoor lights from Habitat that I'm choosing between to make my outdoor space look more expensive this summer

The 6 outdoor lights from Habitat that I'm choosing between to make my outdoor space look more expensive this summerI couldn’t believe some of the prices

By Ellis Cochrane

-

Joseph Joseph 3-piece Saucepan review – seriously space-saving

Joseph Joseph 3-piece Saucepan review – seriously space-savingSmall kitchen? I tested this innovative Joseph Joseph space-savvy set which has foldable handles — and I loved it

By Annie Collyer

-

Forget seating, this is how you should be making the most out of your kitchen island in 2025

Forget seating, this is how you should be making the most out of your kitchen island in 2025Seating doesn't always have to be a necessity on an island when you can choose these ideas instead

By Holly Cockburn