The government announces three-month ‘mortgage holidays’ during the coronavirus pandemic

If you're a financial victim of coronavirus call your lender asap

A mortgage holiday is to be offered to financial victims of the pandemic.

Related: How will Coronavirus affect our finances? Martin Lewis explains all

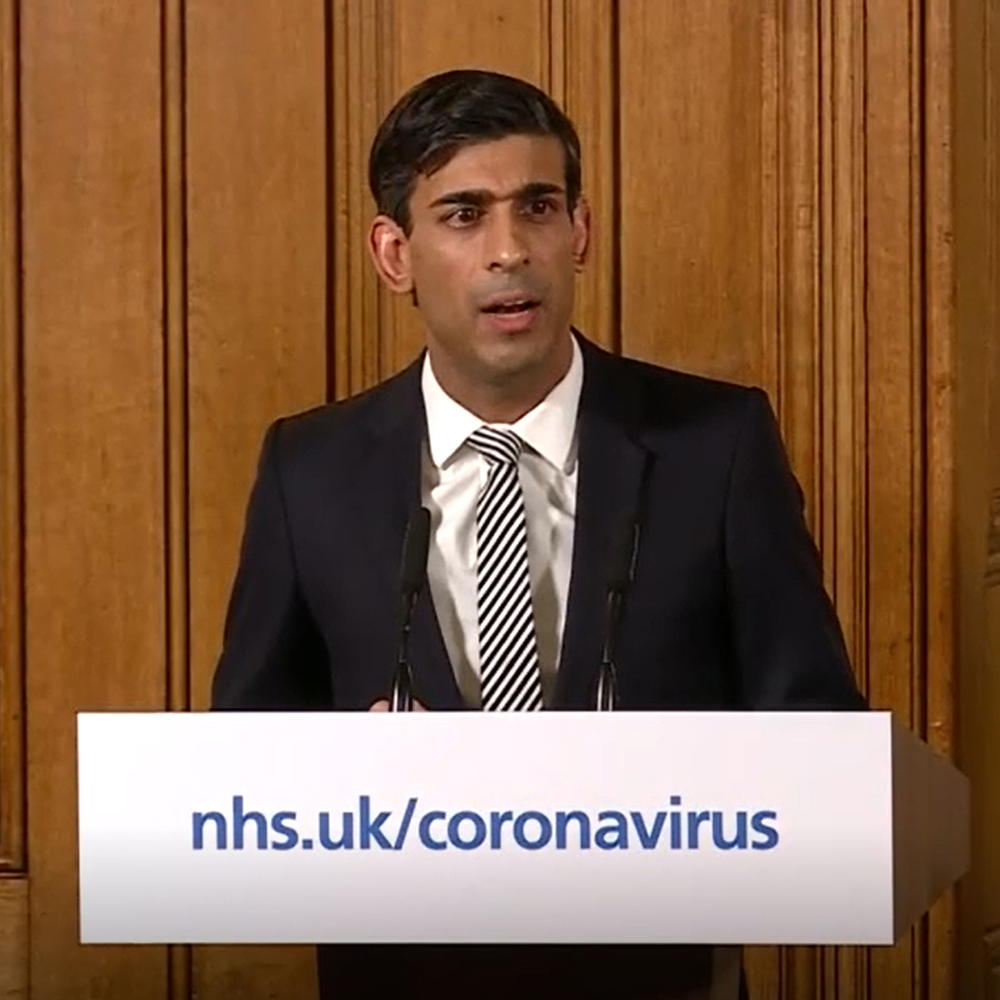

On Tuesday evening, Chancellor Rishi Sunak announced a number of government-back loans to help households struggling financially due to coronavirus. One of those measures included a 'mortgage holiday' for homeowners.

What is a 'mortgage holiday'?

'Mortgage lenders will offer a three-month 'mortgage holiday' for those in financial difficulty due to the outbreak,' he said.

Measures implemented by the UK government and governments abroad have left those in the travel and service industry struggling. 100s of shops, restaurants and salons have closed, leaving many employees uncertain about the future of the jobs and how they're going to pay the bills during this crisis.

If you are in this boat, hopefully, this new mortgage pause will be one less thing on your mind over the next three months.

A number of banks have already said they would give customers the option to pause mortgage payments. These include Lloyds Bank, Halifax, Royal Bank of Scotland, NatWest, TSB, Virgin Money, Clydesdale Bank and Yorkshire Bank.

Get the Ideal Home Newsletter

Sign up to our newsletter for style and decor inspiration, house makeovers, project advice and more.

The payment holiday will not be automatic. Lenders will decide if it's right for a customer on a case by case basis.

If you think it would be the best option for you, you'll need to speak to your bank. You must be able to prove that your finances have been impacted by coronavirus, by either losing your job or self-isolating.

However, customers who have been affected indirectly, such as those with a partner who is unable to work, can still be considered.

Those who qualify for the mortgage holiday won't need to make a payment. However, you will still accrue interest on your mortgage.

Still, you don't need to worry about the pause affecting your credit score. Equifax, Experian and Transunion, the UK's three credit reference agencies, have confirmed that this payment pause will not impact your credit score. But it will still be recorded on credit reports.

Related: Could coronavirus derail the housing market? This is what the experts think

If you think you qualify for a mortgage holiday contact your lender as soon as possible.

Rebecca Knight has been the Deputy Editor on the Ideal Home Website since 2022. She graduated with a Masters degree in magazine journalism from City, University of London in 2018, before starting her journalism career as a staff writer on women's weekly magazines. She fell into the world of homes and interiors after joining the Ideal Home website team in 2019 as a Digital Writer. In 2020 she moved into position of Homes News Editor working across Homes & Gardens, LivingEtc, Real Homes, Gardeningetc and Ideal Home covering everything from the latest viral cleaning hack to the next big interior trend.

-

Typhur Dome 2 air fryer review – a glimpse into the future of air frying

Typhur Dome 2 air fryer review – a glimpse into the future of air fryingThe Typhur Dome 2 cooks food brilliantly and has all sorts of benefits, but is it worth the £499 price tag?

By Ellen Manning

-

In creating their lush multi-use garden, the owners have cleverly futureproofed the space for years to come

In creating their lush multi-use garden, the owners have cleverly futureproofed the space for years to comeWith a zone for dining, a veg plot, a relaxing sun trap, and space for quiet contemplation

By Ginevra Benedetti

-

5 reasons why your grass seed isn’t growing and what you can do to help, according to garden experts

5 reasons why your grass seed isn’t growing and what you can do to help, according to garden expertsFor a lush, green lawn, you have to ensure the conditions are just right

By Kezia Reynolds