Equity release – a guide to accessing the cash tied up in your home

Is equity release the right option for you?

Investing your money in bricks and mortar is often seen as one of the best ways to safeguard your finances for the future. And for those who are approaching retirement age, equity release is becoming an increasingly popular option. It's a way to free up valuable funds from your home, while still being able to live in the property you have come to know and love.

Get to grips with your home financing with our property advice

According to figures from the Equity Release Council (ERC) – a consumer centric trade body representing the equity release sector – the number of equity release customers has leapt up 81 per cent between the first half of 2016 and the first half of 2018.

There are a wide variety of equity release products on the market, so it’s important to assess which one – if any – are right for your circumstances. Our equity release guide will help get you there.

What is equity release?

Equity-release products let you take out a loan against the equity (value) of your home.

Equity release – could downsizing be a better option?

Selling your current home and moving to a smaller property could give you the best of both worlds. Profit from the sale mean you have access to a lump sum of money you can use towards holidays or any other extras you want to enjoy during your retirement, and if the purchase price of your new home is within your cash budget, you could also be mortgage-free.

What is the interest rate on equity release?

Like any loan, equity release products come with an attached interest rate, averaging at around 5.22 per cent as of July 2018. There are both fixed and variable interest-rate equity loans, which are generally higher than many standard mortgage/remortgage interest rates

Can I sell my house if I have equity release?

It will depend on the details of your loan, and you may have to pay some heavy penalties to do so. However, there is a way to take out an equity release product, while still leaving the door open for downsizing your property. According to the ERC almost half (45 per cent) of equity release products now offer downsizing protection.

This means that customers can downsize to smaller home and repay their equity release loan – usually after a qualifying period of five years – without incurring an early repayment charge.

Equity release mortgage – what options are available?

With more than 100 equity release products to choose from, it can be a challenge to navigate their way through the options.

In general, equity release products are available to homeowners generally with a minimum age of 55, and you can search for providers who comply with the ERC’s Product Standards here.

You can also speak to an Independent Financial Advisor, which you can find through a number of means including through the ERC, or by visiting the Society of Later Life Advisors or by using a dedicated comparison sites such as Unbiased.

Broadly speaking there are two types of equity release products – a lifetime mortgage and home reversion. These are explained below:

Lifetime mortgage

A lifetime mortgage sees homeowners take out a mortgage secured on their property – which must be their main residence – while maintaining ownership of their home.

Within lifetime mortgages there are a further three options, though some providers may offer more.

Interest roll-up mortgage:

This type of lifetime mortgage will either offer you a single lump sum or payments made in regular amounts – with interest accrued on the loan amount.

Under an interest roll-up mortgage you won’t need to make regular loan payments, but the amount loaned, plus the rolled up interest – which is compounded each year – will be repaid when your home is sold.

This sale could take place as a result of one of the following scenarios:

- You enter into a long-term care facility

- You die

While the interest rate on a roll-up mortgage may be fixed, it’s important to be aware of just how much of a jump cumulative interest can take under this option.

After the end of first year the interest will be added to your original loan amount. In the following year it will calculated on the original loan plus the interest which was charged in year one, and this process will continue each year of your mortgage loan term.

Interest-paying mortgage:

Under this type of lifetime mortgage you also get a lump sum and you can make interest payments on either a monthly or ad hoc basis.

As with interest-roll up mortgages the amount borrowed will need to repaid once your home is sold. Some products that fall into this bracket will also give you the option to pay off some of the capital.

Equity release providers Legal & General have provided an illustrative example below for an Optional Payment Lifetime Mortgage. This is based on a property value of £300,000, with a borrowing amount of £85,500 at an interest rate of 3.65 per cent and where the borrower is paying 50 per cent of the monthly interest.

| Year | Loan | Interest | Interest Paid | Balance |

| 1 | £85,500 | £3,147 | £1,560 | £87,087 |

| 2 | £87,087 | £3,206 | £1,560 | £88,732 |

| 3 | £88,732 | £3,267 | £1,560 | £90,439 |

| 4 | £90,439 | £3,330 | £1,560 | £92,209 |

| 5 | £92,209 | £3,396 | £1,560 | £94,045 |

| 6 | £94,045 | £3,464 | £1,560 | £95,949 |

| 7 | £95,949 | £3,535 | £1,560 | £97,924 |

| 8 | £97,924 | £3,608 | £1,560 | £99,971 |

| 9 | £99,971 | £3,684 | £1,560 | £102,095 |

| 10 | £102,095 | £3,763 | £1,560 | £104,298 |

Drawdown lifetime mortgage

As with other types of lifetime mortgage you equity release providers will agree an overall amount you can borrow. An initial lump sum will then be advanced while the remainder will be put in a cash reserve facility for you to 'draw down' as needed (minimum amounts may apply).

Interest will then be applied only to the money you have released – including the initial lump sum – and the whole loan will be repaid once your home is sold. You won't need to make monthly payments.

It's important to bear in mind that interest rates may fluctuate each time you 'draw down' from your cash reserve, so a different interest rate may apply each time.

You may also need to wait a period of a few weeks from requesting a draw down to it being approved by your equity release provider.

Home reversion

Home reversion plans will see you selling all or part of your home – usually between 20 per cent and 60 per cent depending on your age – for a tax-free cash lump sum at below market value.

You will also get a lifetime lease, which ensures you can stay in your home rent-free until it is sold as a result of the circumstances already outlined above. You may also be able to transfer your home reversion plan in the event you move to a new property.

There's no need to make either monthly repayments or pay interest. Once your home is sold the revision company will get their share of sale proceeds.

Cost of equity release

Beyond the loan value and interest charges, you will also need to factor in a number of costs – which are roughly add up to between £2,000 and £3,000 – including:

- Arrangement/completion fees for the equity release product itself

- Fees for your financial advisor

- Valuation/survey fee

- Solicitors fees

- Building insurance

What are the downsides to equity release?

Get to grips with home finance: How to live mortgage free? Ask Max McMurdo...

As with any financial products, there are both pros and cons to taking out equity release products, as well as associated risks. Here are just a few:

Lower inheritance pot

The amount you borrow for equity release will naturally reduce the amount of inheritance you will be able to leave for your beneficiaries.

Mounting interest

It's important to asses your budget and identify if you will be able to keep up with monthly interest repayments. A financial advisor will be able to help you determine this.

Missing out on the increasing value of your home

It's important to asses your budget and identify if you will be able to keep up with monthly interest repayments. A financial advisor will be able to help you determine this.

Missing out on the increasing value of your home

If you opt for home reversion, you could miss out on future property price growth for the share you've sold.

Maintaining your property

Your equity release provider may require you to keep your home in a good condition so that it remains saleable, which can be a drawback if you weren't planning on making any further cosmetic changes to your home.

The risk that you won't be able to repay your loan amount

House prices are constantly fluctuating, so in the instant that there is a market crash there could be a risk that you or your beneficiaries won't have the funds to pay back the loan amount or the 'rolled-up' interest. Luckily a number of equity release products offer a 'no negative interest guarantee', which means you or your beneficiaries will never need to pay back more than the value of a property.

Get the Ideal Home Newsletter

Sign up to our newsletter for style and decor inspiration, house makeovers, project advice and more.

-

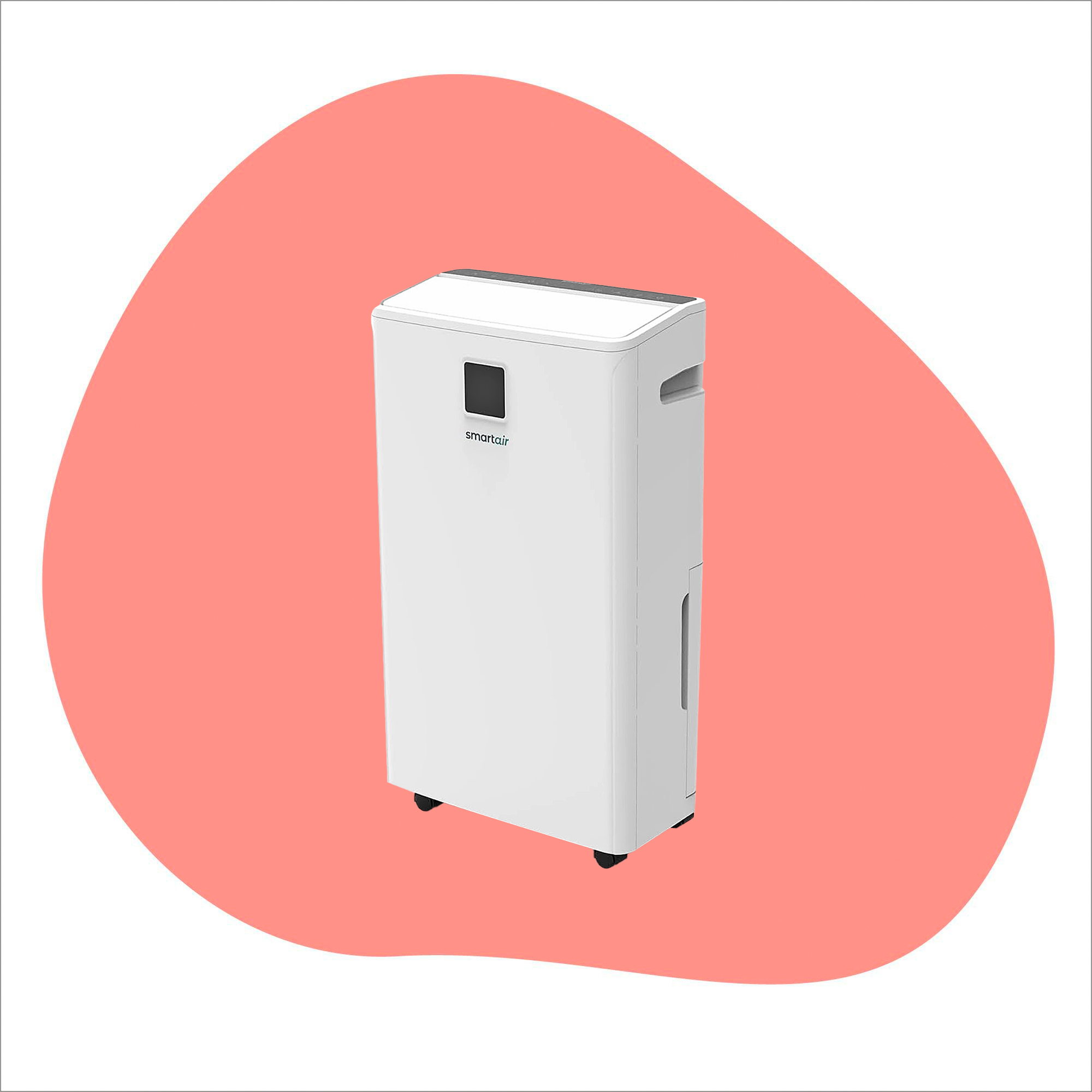

I tried out this neat little dehumidifier for a month – it dried my laundry in half the time

I tried out this neat little dehumidifier for a month – it dried my laundry in half the timeThe 20L SmartAir Dry Zone dehumidifier tackled my laundry drying woes head on

By Jenny McFarlane

-

I’m seeing pastel garden furniture at all my favourite brands this spring, but QVC’s sorbet collection impressed me the most

I’m seeing pastel garden furniture at all my favourite brands this spring, but QVC’s sorbet collection impressed me the mostFresh pastel shades are a great way to liven up your outdoor space

By Kezia Reynolds

-

Don't tell my flatmates, but Joseph Joseph's clever new sink range finally made me enjoy washing up

Don't tell my flatmates, but Joseph Joseph's clever new sink range finally made me enjoy washing upI didn't know stylish washing up accessories existed until I saw this collection

By Holly Cockburn