How to buy a property at auction: step-by-step

Learn the process of bidding for a property at auction, from completing due diligence, to working out when and how to pay for your new home

With the overall process being significantly faster and easier than buying a house through more typical routes, it’s easy to see why buying a property at auction is becoming a popular house-buying option. But what what is the best process on how to buy a property at auction? Our complete guide explains all.

In order for a property auction sale and purchase to run smoothly, the buyer needs to do their research, have legal representation and, most importantly, ensure they have finance in place to be ready to exchange and complete within 56 days of winning a bid.

Read on to find out everything you need for buying a house at auction, followed by expert top tips for the best online auction bidding strategy.

How to buy a property at auction

According to the Essential Information Group, the one-stop-shop for all property auctions, property auction activity in the UK has seen a massive growth over the last year. With reported profits from property auction sales rising from £469m in September 2020 to £539.5m in September 2021.

That’s an impressive 15 per cent growth. ‘From would-be investors taking inspiration from hit shows like Homes Under the Hammer, to first-time home buyers looking at alternative ways to get onto the property ladder, more and more buyers, and sellers, are exploring auction,’ says Jamie Cooke, Managing Director at iamsold.co.uk.

1. How much does it cost to sell at auction?

You’re likely be charged an entry fee to cover the costs of listing your property in the auction catalogue and a commission fee if your property is sold, either calculated as a percentage of the sale price or as a flat fee.

You’ll also be required to pay for and provide a legal pack detailing information such as title documents, local searches, energy performance, tenancy agreements or management details if the property is leasehold, for example. It’s made available on the auctioneer website for prospective buyers and can cost anything up to around £500.

‘It details all the things you’d usually find out later down the line during the conveyancing process when purchasing by Private Treaty (the way most people buy and sell their homes),’ says Jamie Cooke.

2. How much does it cost to buy at auction?

The cost of buying a house can vary enormously. ‘There’s something for every budget at auction; whether you’re looking for a bargain or something spectacular,’ says Jamie Cooke, ‘At iamsold.co.uk, our highest value sale was £1.3m and the lowest was land for £300!’

Colin Secomb, Joint Managing Partner at solicitors Lewis Denley, reminds buyers not to forget solicitor fees for buying a house. Also to look out for any hidden costs in the contracts before you place a bid.

‘Be aware of any additional costs often included in auction contracts which can include the seller’s legal fees and the seller’s sale commission fees of up to three per cent of the purchase price,’ Colin says.

3. How do you make a bid?

Each property will be listed with a guide price. The seller will also have a reserve price, kept confidential, detailing the minimum they are willing to accept.

- Bidding in person: Some auction houses will supply you with a paddle (or something similar) which you hold up as you verbally say your bid out loud. The auctioneer will make it apparent during the bidding process as to where and what the current bid is in the room. If you can’t bid in person, someone such as an agent or solicitor, can bid on your behalf. Some auctioneers will also accept phone or proxy bids, but the auctioneer will need written confirmation from you and a cheque for the deposit to be able to accept your bid.

- Bidding online: For online auctions, there are two ways you can bid – live online bidding and online proxy. With online bidding, you can watch the auction countdown online, and you place your bids live. If you are unable to bid live, you can pre-submit your highest offer by online proxy. The proxy bidding is regulated automatically and you will be notified if your bid has met the reserve price.

If a property doesn’t reach the reserve price during bidding, the property won’t be sold. However, if you’re still interested in buying, you could negotiate with the seller after the auction has taken place.

4. How do you pay for an auction home?

The traditional method of auction is when the property is auctioned to ‘in-room’ bidders, as well as online, telephone and by proxy. Once the gravel falls, the highest bidder wins and has to exchange contracts and pay a 10 per cent deposit straight away. They then have 28 days to complete the sale.

The modern method of auction is a bit like eBay style bidding and takes place online only. When the final bid is accepted, you don’t have to exchange contracts immediately. The buyer pays a reservation fee (not a deposit), which is non-refundable if you pull out of the purchase. You then have 56 days to exchange contracts and complete the purchase. This route gives the buyer more time to sort out their finances.

5. How do you pay for a successful bid?

Historically, auctions were mostly open to cash buyers and investors. Nowadays, it is much easier to buy a home at auction with a mortgage. ‘There is criteria that needs to be met and not all auction properties are eligible for a mortgage for reasons such as it's a non-standard structure, or has a short leasehold,’ says Jinesh Vohra CEO at Sprive.com.

‘You’ll need to secure a mortgage-in-principle and it's a good idea to have an independent mortgage valuation done on the property to make sure your lender is willing to lend on the property,’ says Jinesh. ‘You don't want to bid on a property over the price it's been valued. If you do, it may compromise your mortgage application.’

6. What are the risks of buying a property at auction?

As with any high-cost purchase, there is always going to be a risk when buying a house, regardless of what route you take to purchase it. ‘You might realise the property isn’t quite what you want or may not be suitable for your circumstances,’ says Jamie Cooke.

What’s more, unlike a traditional house purchase, an auction is binding as soon as the winning bid is accepted. So if you pull out of the sale, you will lose any monies already paid and be liable for hefty administration fees.

However, as long as you study the small print in the legal pack, with the help of a solicitor, you should be in a good position to know exactly what you are purchasing – in order to make an informed decision and reduce any risk.

‘Doing your homework on the property prior to going to auction and committing to buy one is key,’ says Dale Anderson, MD of Fabrik Invest.

7. What are the benefits of buying a property at auction?

There’s a good chance that you might find a great deal and you can move quickly as the exchange and complete process happens usually within 28 days. What’s more, you can’t be 'gazumped' after your bid has won, because contracts are signed straight away.

8. What should you do before going to auction?

Do due diligence on the house you’re bidding on. This requires visiting the property, researching the area and potentially organising an independent survey and house valuation.

‘You need to ensure you are aware of the prices the properties tend to sell for, then you can set yourself a realistic maximum bid,’ says Jamie Williams, Specialist Property Finance Expert at Pure Property Finance.

You also need to be able to prove that you have the funds readily available straight away and also sort out buildings insurance to be valid on the day of auction, as this is the day you exchange and are legally bound to buy the property.

9. What should I ask an agent before auction?

Ask them to clearly outline the process involved and provide all the information about the auction property. ‘Check who is responsible for the fees and whether there are any seller fees to pay as this can differ from provider to provider,’ says Jamie Cooke.

Top tips for a best online auction bidding strategy

Register your account

You need to make sure you have an account organised with the auction house so that you can place a bid. ‘Take a note of when the auction ends, so you don’t miss the opportunity to place your bid. On average they are live for around seven to 30 days,’ says Jamie Cooke.

Choose your limit

Make sure you’re bidding with your wallet, not your heart. It’s easy to get caught up in the thrill of the moment. ‘Always stick within your means, be fully informed of the process and communicate with your agent if you have any questions,’ says Jamie Cooke

Do your research

Read the terms & conditions, and get as much information about the property before you make your bid. ‘Use websites such as Rightmove and Zoopla and undertake a valuation opinion via some local estate agents who are active in that area, says Dale. ‘Make sure you are getting good value so that your purchase makes solid financial sense.’

Have good WiFi

Make sure your internet is fast and the broadband connection is good, you don’t want to miss out on the home of your dreams or an amazing investment because the Wi-Fi cuts out.

Get the Ideal Home Newsletter

Sign up to our newsletter for style and decor inspiration, house makeovers, project advice and more.

Sophie Vening is a freelance journalist and editor with more than 16 years’ experience writing about homes and properties. She’s worked for some of the UK’s leading interiors, self-build and property titles including, Grand Designs, Ideal Home, House Beautiful, Build It, The Metro Homes & Property and The Evening Standard Homes & Property.

She enjoys writing about complex issues in an easy-to-understand way.

-

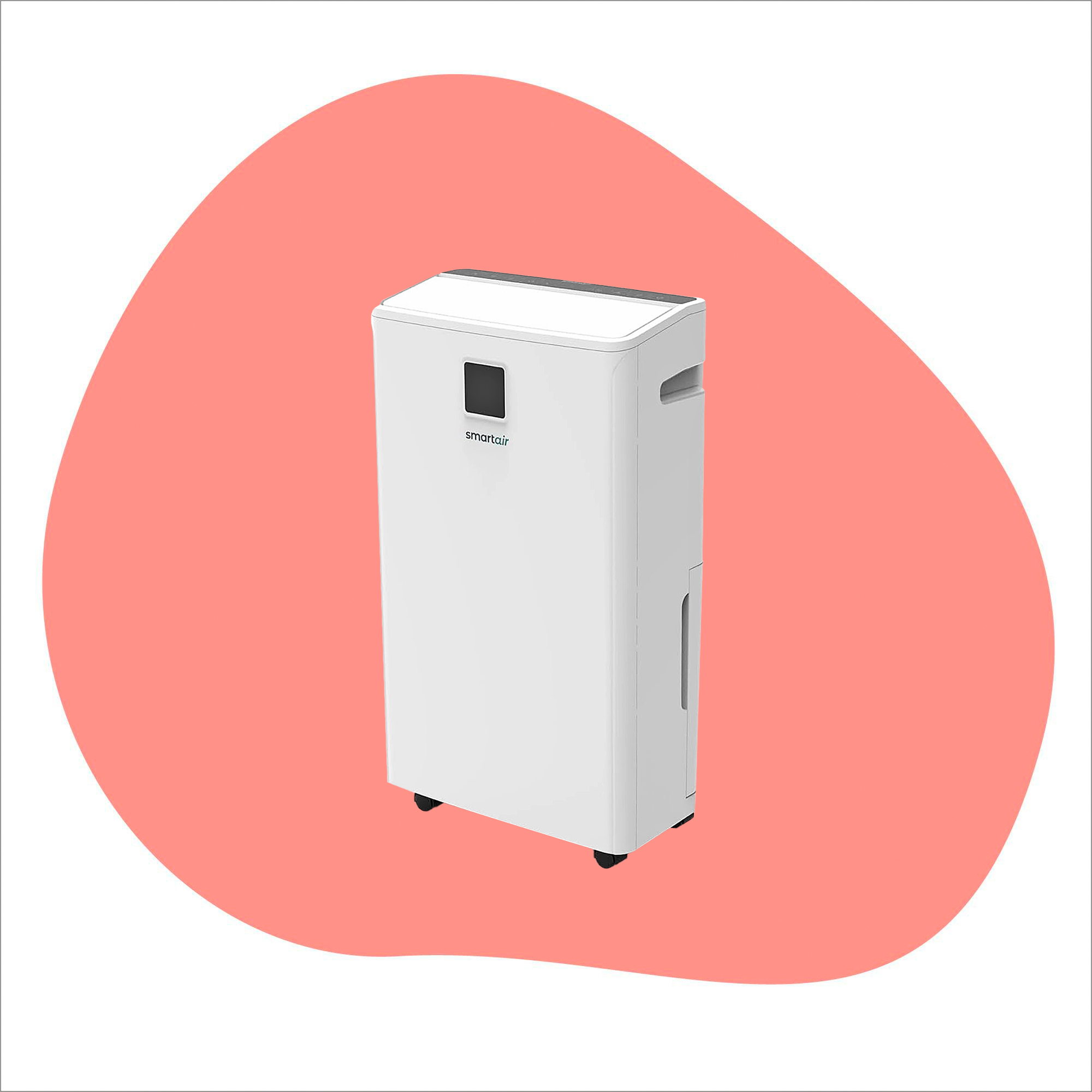

I tried out this neat little dehumidifier for a month – it dried my laundry in half the time

I tried out this neat little dehumidifier for a month – it dried my laundry in half the timeThe 20L SmartAir Dry Zone dehumidifier tackled my laundry drying woes head on

By Jenny McFarlane

-

I’m seeing pastel garden furniture at all my favourite brands this spring, but QVC’s sorbet collection impressed me the most

I’m seeing pastel garden furniture at all my favourite brands this spring, but QVC’s sorbet collection impressed me the mostFresh pastel shades are a great way to liven up your outdoor space

By Kezia Reynolds

-

Don't tell my flatmates, but Joseph Joseph's clever new sink range finally made me enjoy washing up

Don't tell my flatmates, but Joseph Joseph's clever new sink range finally made me enjoy washing upI didn't know stylish washing up accessories existed until I saw this collection

By Holly Cockburn

-

You can claim back over £300 a year from HMRC if you work from home - here’s how to check if you’re eligible

You can claim back over £300 a year from HMRC if you work from home - here’s how to check if you’re eligibleWhen it comes to saving, every little helps

By Kezia Reynolds

-

Experts have revealed the best day to renew your home insurance policy - you’ll want to do it sooner rather than later

Experts have revealed the best day to renew your home insurance policy - you’ll want to do it sooner rather than laterDon't leave this task at the bottom of your to do list

By Kezia Reynolds

-

Is a variable rate mortgage ever a good idea? Experts weigh in

Is a variable rate mortgage ever a good idea? Experts weigh inOur money expert explains what a variable rate mortgage is, who they can be good for, and the pros and cons of this kind of mortgage

By Samantha Partington

-

I’m a first-time buyer, what are my chances of getting a mortgage right now?

I’m a first-time buyer, what are my chances of getting a mortgage right now?And what you can do to increase your odds

By Rachel Wait

-

Should you ever pay above the asking price for a home?

Should you ever pay above the asking price for a home?Our money expert explains whether you should ever pay over the asking price for a home, especially if house prices fall as predicted

By Samantha Partington

-

Should I fix my mortgage and how long should I fix for?

Should I fix my mortgage and how long should I fix for?We speak to the experts to find out whether you should fix your mortgage and how long for as well as the impact further interest changes could have on your decision

By Samantha Partington

-

We put your mortgage questions to two leading experts, here's what they said

We put your mortgage questions to two leading experts, here's what they saidAs mortgage panic continues, we've answered the most common questions - from when mortgage rates will come down, to when you actually have to pay stamp duty

By Samantha Partington

-

'My mortgage is set to skyrocket - what should I do?' 5 potential solutions from a money expert

'My mortgage is set to skyrocket - what should I do?' 5 potential solutions from a money expertIf you're facing higher mortgage costs, our money expert explains various courses of action you could take to ease the pressure

By Samantha Partington